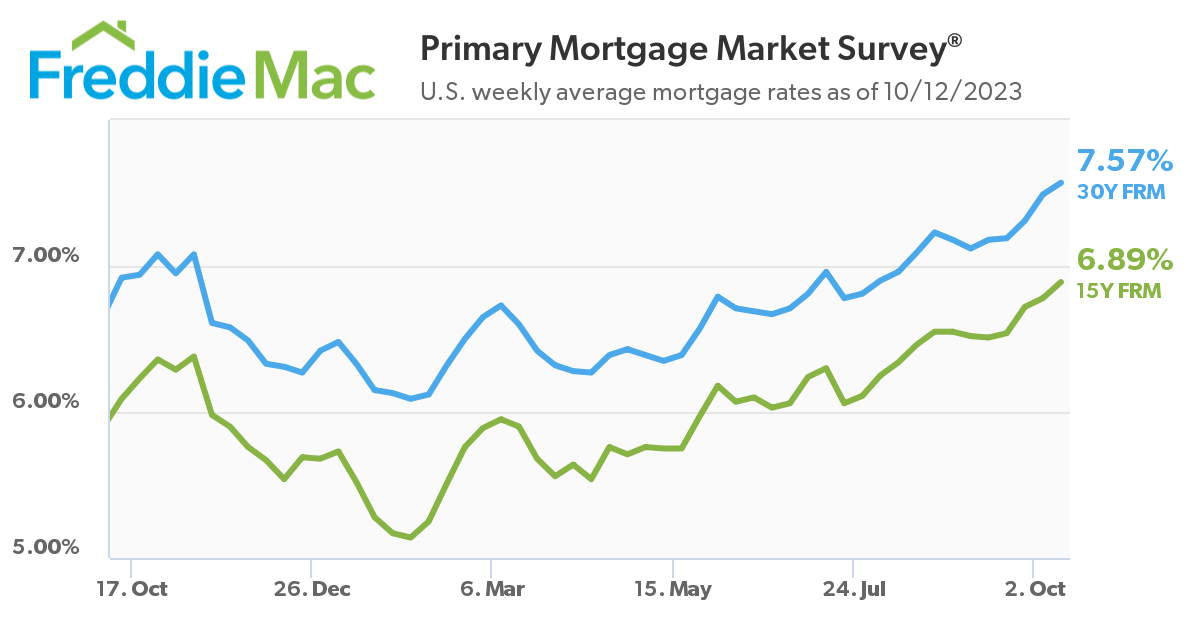

Mortgage rates have recently been on the rise, capturing significant attention from the media. If you’ve been following the headlines, you might have noticed that rates have reached their highest levels in over two decades. This can be a disheartening development if you’re contemplating a significant move. So, if you’re deliberating whether to postpone your plans, here’s what you should consider:

How Higher Mortgage Rates Impact You

There’s no denying that current mortgage rates are higher than they’ve been in recent years. When rates increase, they affect the overall affordability of homes. The mechanism is straightforward: as rates climb, the cost of borrowing money for your home purchase rises, and consequently, your monthly mortgage payments for your future home loan increase.

The Urban Institute explains how this is currently affecting both buyers and sellers:

“When mortgage rates rise, the monthly housing payments for new purchases also go up. For potential buyers, these increased monthly payments can reduce the pool of affordable homes available… higher interest rates incentivize existing homeowners to hold on to their properties to maintain their low-interest mortgages.”

Some individuals are reconsidering their plans because of the current mortgage rate scenario. However, the critical question is whether this is a prudent strategy.

Where Will Mortgage Rates Go from Here?

If you’re eagerly awaiting a decline in mortgage rates, you’re not alone. Many are in the same boat, hoping for a drop. Yet, it’s important to recognize that no one can predict when this will happen. Even experts cannot offer a definite prognosis for the future.

While forecasts indicate that rates may decrease in the coming months, recent data shows an upward trend in rates. This incongruity underscores the unpredictability of mortgage rate projections.

The best advice for your next move is not to attempt to control the uncontrollable, such as timing the market or forecasting mortgage rate trends. CBS News advises:

“If you’re in the market for a new home, experts typically recommend focusing on finding the right property rather than being overly concerned with the interest rate environment.”

Instead, concentrate on building a team of experienced professionals, including a trustworthy lender and real estate agent, who can explain the market dynamics and their implications for you. Whether you’re relocating due to a job change, a desire to be closer to family, or another major life shift, the right team can help you attain your objectives, even in the current landscape.

The Bottom Line

The best advice is not to try to control factors beyond your control, especially mortgage rates. Even experts cannot predict the future. Do prioritize building a team of reliable professionals who will keep you well-informed. When you’re ready to start the process, let’s connect; I can help you build that team!

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link